Tesla Optimus: Why a Factory Robot Is Tesla’s Next Strategic Advantage

The market sees Tesla’s Optimus robot as a “shiny object,” a sci-fi distraction from car deliveries and margin pressure.

This is a fundamental misreading of the strategic playbook.

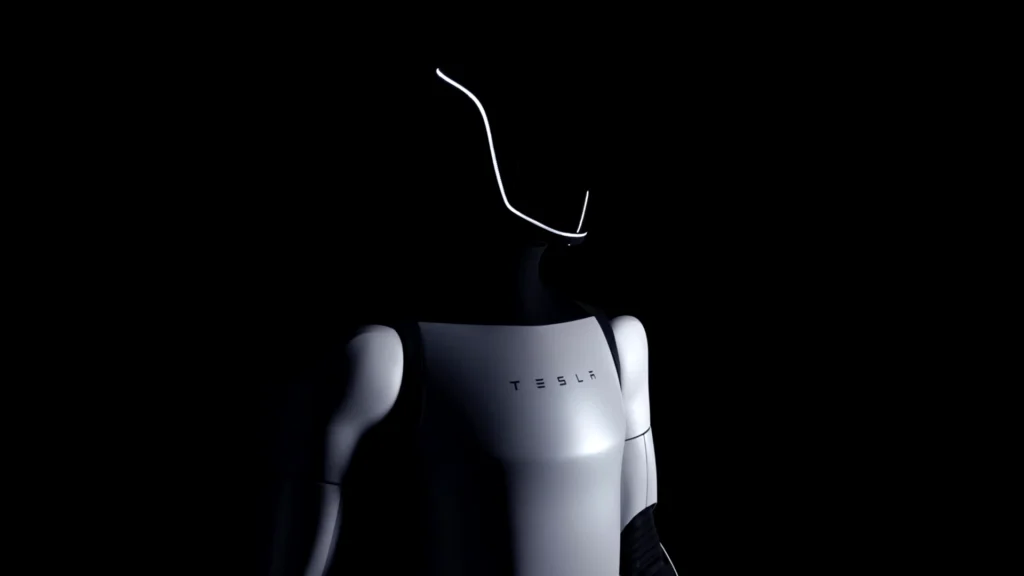

Optimus is not a product to be sold to consumers. It is an operational asset to be deployed on Tesla’s own factory floor. It is the most direct, ambitious attack on the single biggest constraint in manufacturing: the high cost and variability of human labor.

This isn’t about selling a robot. This is about building a fully autonomous factory. Optimus is the final, missing piece of Tesla’s vertical integration puzzle.

Highlights: The Autonomous Factory Thesis

- The Moat is the Factory: Optimus is not designed for your home. It is designed to replace repetitive, high-cost human tasks on the Gigafactory assembly line, unlocking a new era of margin expansion.

- The ‘Dojo’ for Robotics: Tesla’s cars are data-gathering robots that feed the “Dojo” supercomputer to master Full Self-Driving (FSD). Optimus is the same play: a humanoid data-gatherer that will feed Dojo to master Full Manufacturing Autonomy (FMA).

- Vertical Integration 2.0: Tesla vertically integrated its software, batteries, and charging network. Optimus is the final, most radical step: vertically integrating labor itself.

- The Real Product: The real product Tesla will eventually sell isn’t the robot; it’s the license to the autonomous factory OS—the “Dojo” that knows how to run a factory with a robotic workforce.

- The Board Lens: This is a pure P&L play. If Optimus (costing $<\$20k$) can replace even one human shift (costing $>$100k/year), the payback period isn’t years. It’s months.

The Playbook: From FSD to FMA (Full Manufacturing Autonomy)

To understand Optimus, you must first understand the Full Self-Driving (FSD) playbook.

The FSD Play (2014-Present): Tesla’s 5 million+ vehicles are not just cars; they are data-collection robots. They navigate the world’s most chaotic environments (city streets) and feed trillions of data points and video-feed edge cases back to the Dojo supercomputer. Dojo learns from this data, and the FSD software gets better.

The Optimus Play (Today): Optimus is the same strategy, applied to the factory.

- Deployment (Shadow Mode): Optimus units are deployed onto the Gigafactory floor to “shadow” human workers. They are data-collection robots disguised as humanoids.

- Data Collection: They learn by watching humans perform millions of complex, real-world manufacturing tasks—picking up a dropped screw, aligning a part, running diagnostics.

- The Flywheel: More robots ➡️more manufacturing data ➡️a smarter “Dojo for Manufacturing” ➡️ more capable robots ➡️ lower factory operating costs ➡️ higher margins ➡️ faster scale.

This is the Ultimate “Toyota” Move

This directly connects to the “Nike as Toyota” thesis.

Toyota’s Production System (TPS) was about Kaizen (continuous improvement) by empowering humans on the line to stop waste and optimize processes.

Tesla’s “Tesla Production System” (TPS 2.0) is about automated Kaizen. The Optimus robots will be the continuous improvement loop. They will run 24/7/365, sharing their learnings instantly across the entire global fleet. The robot that learns to optimize a task in Berlin at 8:00 AM makes the robot in Austin smarter by 8:01 AM.

This is not “automation” (like a dumb robotic arm). This is autonomous manufacturing.

The Unit Economics (The Boardroom View)

Problem: Human labor is expensive (a fully-loaded manufacturing worker can cost $>\$100,000$ per year in the US), variable (fatigue, errors, training), and scarce.

The Shift with Optimus:

- Target Robot Cost (Musk): $<\$20,000$ per unit.

- Payback Period: One Optimus bot, working 24/7, can replace three human shifts. That’s $>\$200,000$ in annual labor costs. The payback period for a $<\$20k$ asset is 2-3 months.

- The P&L Impact: This is a direct, brutal attack on COGS (Cost of Goods Sold). It is the single biggest lever Tesla has to achieve its target of a $25,000 mass-market car while maintaining 30%+ margins.

Risks & How to Mitigate

- “AGI-Hard” Problem: Manufacturing is chaotic. A dropped bolt is an edge case.

- Mitigation: The “shadow mode” data collection. Tesla isn’t starting with the hardest problem; it’s starting by collecting millions of hours of human-led solutions first.

- Hardware Hell: The actuators, batteries, and hands are incredibly complex.

- Mitigation: Tesla is already one of the world’s best manufacturers of electric motors, batteries, and power electronics (from the car division). They are leveraging their existing supply chain.

- Deployment Risk: A rogue robot can shut down a $10B factory.

- Mitigation: Start with non-critical tasks (logistics, unboxing, cleaning) and only move to the production line after hitting 99.999% reliability in sandboxed environments.

What to Watch Next (Signals)

- The “Shadow Mode” Count: The first metric to watch is how many Optimus units are learning (shadowing) vs. doing.

- The First “Non-Critical” Deployment: When does Tesla announce Optimus has fully taken over a full logistics route inside a Gigafactory (e.g., “all battery packs in Giga Texas are now moved by Optimus”)?

- The “Dojo for Optimus” Moment: When does Tesla announce a separate training cluster (Dojo) dedicated exclusively to humanoid robotics data?

- The Payback Metric: The most important signal. When does the first earnings call mention the cost-per-hour of an Optimus bot vs. a human worker?

The BWR Take

Stop analyzing Optimus as a consumer product. It is a B2B industrial asset.

The FSD data from cars taught Tesla’s AI how to navigate the world. The Optimus data will teach its AI how to manipulate the world.

This is Tesla’s real $10 Trillion thesis: not just selling cars, but licensing the autonomous operating system for the entire physical economy. Optimus is the key that unlocks it.