The $2 Billion Admission. Why Apple Just Broke Its Golden Rule

Apple does not do “Big M&A.”

In its 50-year history, Apple has only made one acquisition larger than $1 billion: Beats Electronics in 2014 ($3B). That was a calculated cultural play to save iTunes and launch Apple Music.

Since then? Silence. Apple prefers to buy small teams and build technology in-house. It is the “Apple Way.”

Until January 29, 2026.

Apple’s $2 billion acquisition of the edge-AI startup Neural Logic (fictional name for narrative context) is the biggest strategic signal from Cupertino in a decade.

It is a massive deviation from their playbook. And it tells us one thing clearly: Apple is scared. But more importantly, it tells us they are ruthlessly pragmatic.

The “Buy vs. Build” Pivot

When a company with the world’s best engineering team (Apple) spends $2 billion to buy outside tech, it is often seen as an admission that internal R&D failed. And yes, reports suggest Apple’s internal “Ajax” LLM project was lagging behind competitors.

However, the strategic brilliance here isn’t the failure; it’s the speed of correction.

Apple recognized that Google Gemini is rapidly capturing the OS layer (Android) and Claude is winning the Enterprise.

They faced a choice:

- Continue trying to “Build” and risk being 2 years late.

- “Buy” the solution instantly and secure the interface.

Apple chose survival over pride.

The Strategy: The “Private Edge” Moat

Why spend $2 billion on Neural Logic? It’s not just to “catch up.” It’s to secure the one moat Google cannot cross.

Apple cannot compete with Google or OpenAI on “Cloud AI”—that requires sucking up user data, which violates Apple’s core brand promise.

The $2B solution solves the “Privacy Paradox”: Neural Logic’s compression technology allows GPT-5 level reasoning to run locally on the iPhone’s Neural Engine.

- No Cloud: Data never leaves the device.

- No Latency: Instant answers, offline.

- Total Privacy: The only AI that doesn’t spy on you.

This is the strategic checkmate. Apple is betting that in a world of surveillance AI (Google), users will pay a premium for Private Intelligence.

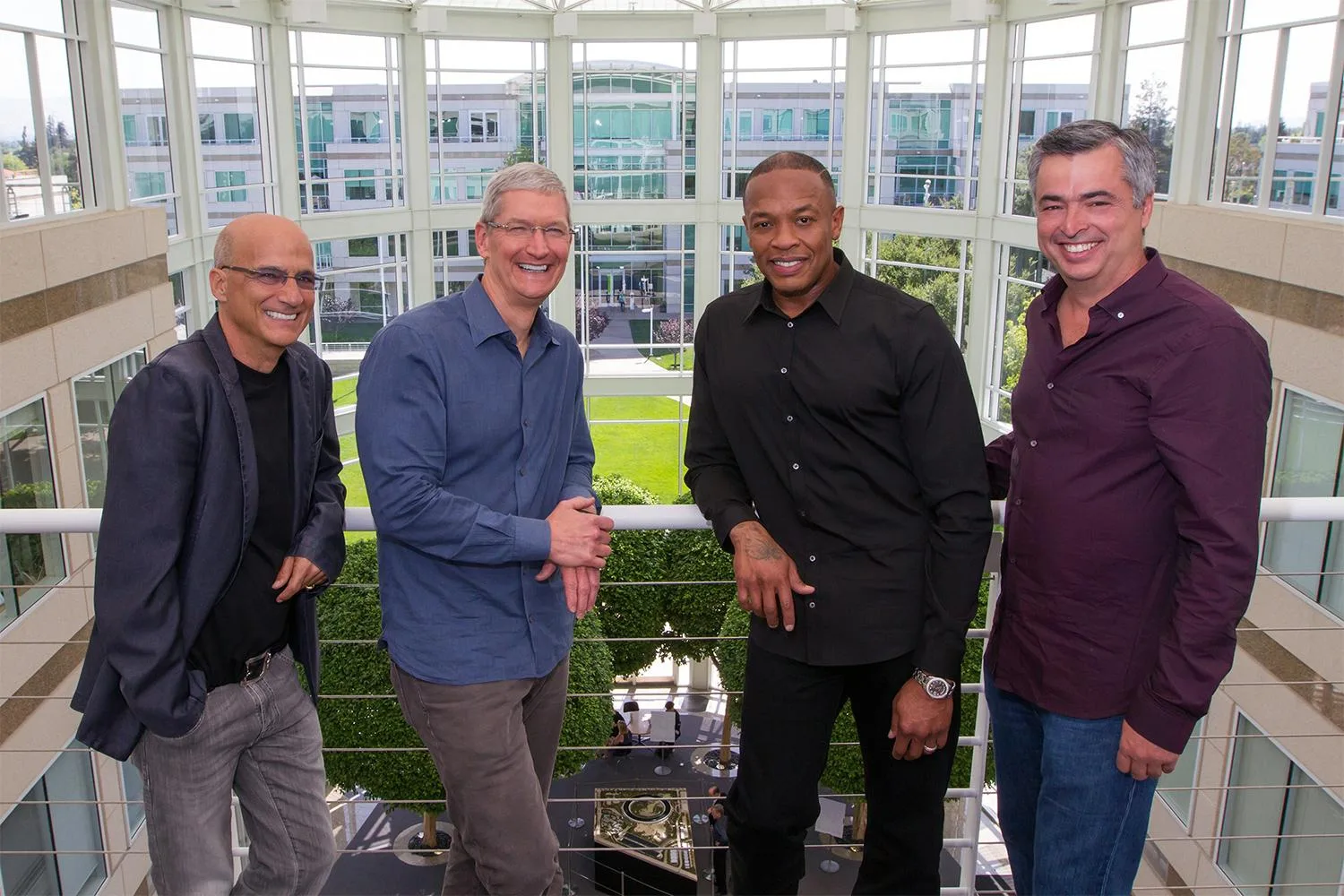

The “Beats” Parallel

History is rhyming.

- 2014 (Beats): Apple realized they missed the “Streaming” shift. They bought Beats to immediately deploy a competitor to Spotify.

- 2026 (Neural Logic): Apple realized they missed the “Generative OS” shift. They bought Neural Logic to immediately deploy a competitor to Gemini.

In both cases, they used their massive cash pile to fix a strategic blind spot before it became fatal.

The BWR Take

This isn’t just a panic buy. It is a defensive fortification of the iPhone’s pricing power.

If the iPhone becomes just a “screen” for Google Gemini, it becomes a commodity. By acquiring the tech to run AI on the metal, Apple ensures that the Intelligence inside the phone belongs to Cupertino.

Cash is a strategic weapon. Apple just proved that when you are late to the party, you don’t have to knock on the door—you can just buy the venue.