Bed Bath & Beyond’s Comeback: How a Bankrupt Brand Plans to Open 300 Stores in 24 Months

The retail graveyard is littered with forgotten giants. Two years after its spectacular collapse and bankruptcy in 2023, Bed Bath & Beyond is trying to claw its way out.

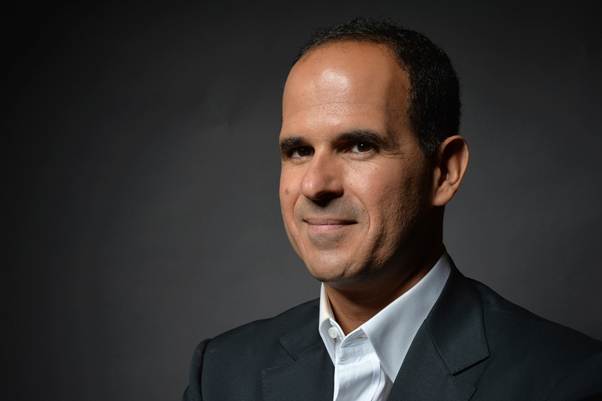

The brand, now owned by Beyond, Inc. (formerly Overstock) and guided by the strategic hand of The Profit’s Marcus Lemonis, has a plan that seems almost absurd in today’s digital-first world: open 300 new physical stores in 24 months.

Is this a desperate gamble on a nostalgic name, or is it a strategic masterstroke hiding in plain sight?

Let’s break down the playbook.

An Autopsy of a Retail Giant

Bed Bath & Beyond’s death wasn’t a sudden event; it was a slow bleed caused by a thousand self-inflicted cuts. The core failures were a masterclass in how to lose relevance:

- Decision Fatigue as a Business Model: Stores became overwhelming, cluttered warehouses. Instead of making it easy to buy, they made it exhausting to browse.

- Digital Disinterest: Their e-commerce experience felt a decade behind, failing to compete with the seamless convenience of Amazon or the curated style of niche competitors.

- Alienating the Core: In a disastrous move, they pushed out popular national brands in favor of cheap private-label products, alienating the loyal customers who had come for those very brands.

- The Coupon Trap: The iconic 20% off coupon became an addiction. It trained customers never to pay full price, destroying margins and turning every sale into a race to the bottom.

The company chased trends instead of doubling down on its strengths, leaving it with a brand everyone knew but no one needed.

The Lemonis Prescription: A Strategic Reset

The new strategy isn’t about reopening old stores; it’s about launching a new kind of company that happens to share a famous name. Each part of the plan is a direct antidote to the poison that killed the original.

- Smaller, Smarter Footprints: The new stores are planned to be smaller and tech-enabled. This is a direct rejection of the old warehouse model. A smaller footprint means lower overhead, higher sales per square foot, and a curated experience that respects the customer’s time.

- Curation Over Endless Aisles: The new inventory strategy focuses on best-sellers and beloved national brands. This isn’t just about selling products; it’s about rebuilding trust. The message: “We know what you love, and we’ve brought it back.”

- A Bet on Profitable Experiences: The plan hinges on making stores destinations again. By integrating a smooth online-offline experience, they aim to deliver the convenience of e-commerce with the instant gratification of taking a product home the same day.

Lessons for Founders & Brand Builders

The revival of Bed Bath & Beyond is a live-action case study for every leader. The key takeaways are clear:

- Brand Equity is a Head Start, Not a Finish Line: A beloved name gets you a second chance, but it won’t save a broken business model.

- Operational Clarity Wins Over Brand Nostalgia: The comeback hinges on Marcus Lemonis’s focus on process and efficiency, not just resurrecting a logo.

- Physical Retail Isn’t Dead; Undifferentiated Retail Is: A physical store must offer something Amazon can’t: curation, experience, and immediacy.

- Don’t Alienate Your Core in Pursuit of a New One: Never forget the customers who made you successful in the first place.

The Final Word

This new chapter isn’t just a comeback. It’s a strategic do-over.

Bed Bath & Beyond is no longer trying to be the biggest store with the most stuff. It’s making a bet that the future of retail isn’t about being the biggest, but the smartest.

And it’s a powerful reminder that even a brand left for dead can win again, but only if it’s willing to bury the model that killed it.