Adobe Acquires Semrush: The $1.9Bn Bet to Own “Discovery”

Adobe has announced a definitive agreement to acquire Semrush for $1.9 billion in an all-cash deal at $12/share, a massive ~77% premium. The deal is expected to close in the first half of 2026.

The market sees this as a software tuck-in.

This is a shallow reading.

This deal is the price Adobe is willing to pay to pivot its entire strategy from “own the content supply chain” to “own the discovery of that content.”

After the regulatory collapse of the Figma deal in 2023, Adobe realized it couldn’t buy more “creative tooling” without antitrust heat. So it shifted vertically. Instead of buying another design tool, it bought the Marketing Cloud extension that validates the design.

By buying Semrush, Adobe is building the infrastructure for Generative Engine Optimization (GEO); helping brands control how they show up not just in Google Search, but in ChatGPT, Gemini, and the agentic web.

Highlights: The “Scientific Creative” Thesis

- The Deal Metrics: At $1.9B cash ($12/share), Adobe is paying a premium to lock in the SMB and Mid-market data layer that feeds its new “Brand Concierge” agentic workflows.

- From SEO to GEO: The “Why” isn’t just Google anymore. It’s about optimizing content for LLMs. Semrush’s data allows Adobe to tell a marketer: “Here is how your brand appears in ChatGPT vs. Gemini, and here is the asset you need to generate to fix it.”

- The Missing Link: Creative Cloud users have always had to leave Adobe to find out what to create. Semrush fixes that. Now, the data on “what people are searching for” lives inside the tool used to build the answer.

- The Post-Figma Pivot: Blocked from buying Figma (design), Adobe moved to the Go-To-Market stack. This extends their Experience Cloud capabilities deeper into the open web and social visibility, areas where they lacked granular data.

The Playbook: Why $1.9Bn is a Bargain

This acquisition executes three critical strategic moves that redefine Adobe’s moat.

Move 1: The “Intent-to-Asset” Pipeline

Currently, the marketing workflow is fractured. You do keyword research in Semrush (Tab 1), write a brief (Tab 2), and design in Photoshop (Tab 3).

Adobe’s play is to collapse this. Imagine opening Photoshop, and a sidebar tells you: “The top-ranking images for this keyword use blue backgrounds and feature human faces.”

That is the Intent-to-Asset pipeline. It creates a dependency on Adobe not just for tools, but for strategy.

Move 2: Weaponizing Firefly (Generative Engine Optimization)

Generative AI creates a flood of mediocre content. The differentiator isn’t volume; it’s relevance.

Adobe can now train Firefly not just on aesthetics (composition, lighting), but on performance (CTR, search volume, LLM citation). They can offer the holy grail: Generative Engine Optimization (GEO). A system that auto-generates variants of a landing page header, tests them against Semrush difficulty scores for AI Overviews, and publishes the winner.

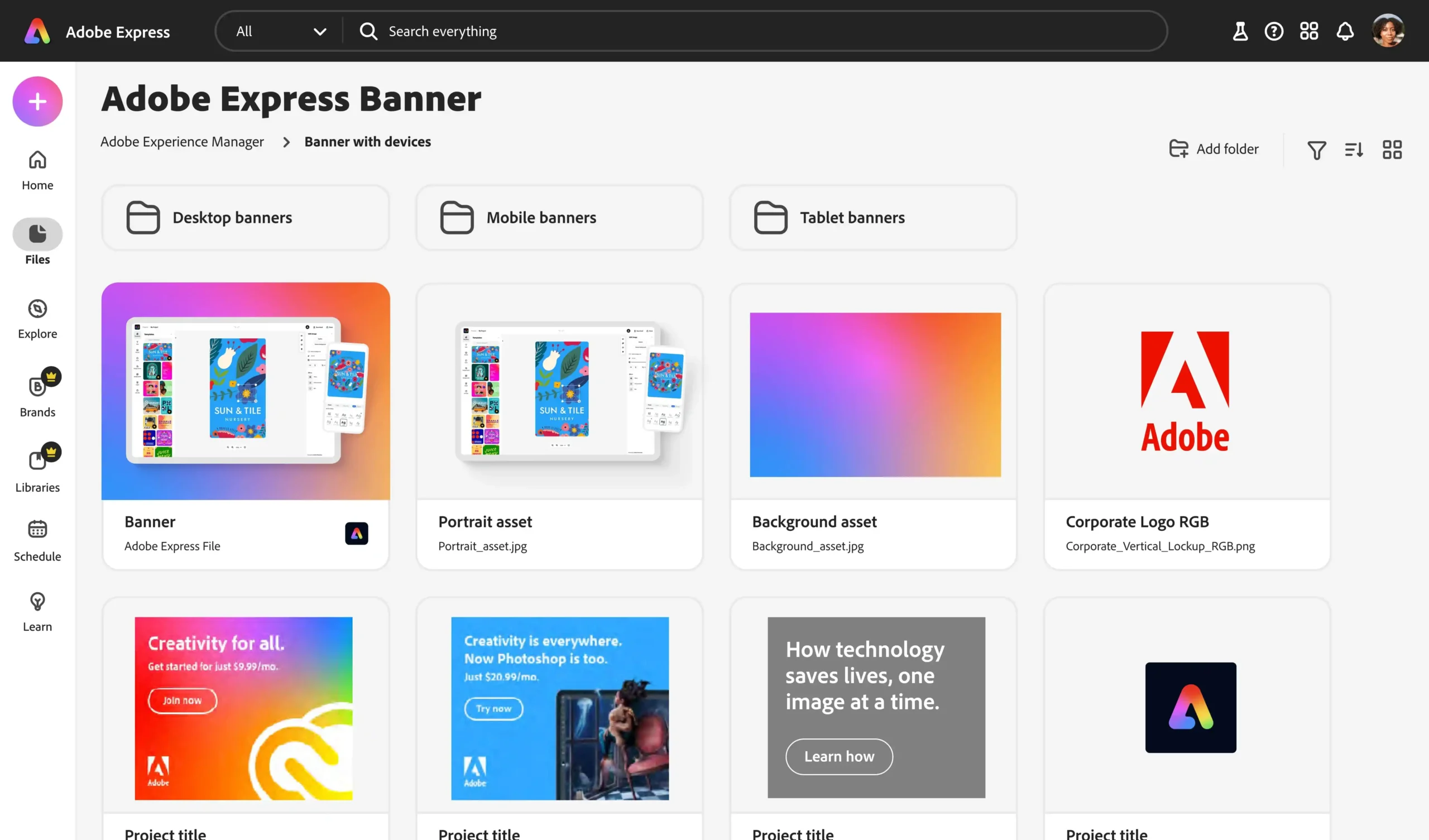

Move 3: The Canva Killer (Adobe Express + Semrush)

Canva is winning the “non-pro” market because it’s easy. But Canva is still a design tool.

By integrating Semrush into Adobe Express, Adobe changes the value proposition. It tells the small business owner: “Canva helps you design a flyer. Adobe Express tells you what to put on the flyer to get customers.”

That is a winning wedge in the SMB war.

The Economics (Boardroom View)

- CAC Efficiency: Adobe spends massive amounts on marketing to acquire SMBs. Semrush has a PLG (Product-Led Growth) engine that acquires them organically through SEO tools.

- Retention (Churn Reduction): A designer might cancel Photoshop if they lose a client. A marketer never cancels their data source (Semrush) because they go blind without it. Bundling data reduces churn.

- ARPU Expansion: This allows Adobe to add a “Marketing Intelligence” tier to Creative Cloud, potentially raising Average Revenue Per User (ARPU) by $30-$50/month without building new infrastructure.

The Risks

- Culture Clash: Adobe is a polished, enterprise-heavy giant. Semrush is a scrappy, high-velocity SaaS tool. Integration paralysis is a real threat.

- Data Privacy: Using Semrush data to train Firefly models could trigger a backlash from users who don’t want their proprietary keyword strategies feeding the global brain.

- Platform Neutrality: Marketers love Semrush because it’s neutral. If Adobe biases the data to favor Adobe-hosted content, trust evaporates.

The BWR Take

The era of “gut feeling” creativity is dying. The era of Performance Creativity is here.

Adobe realized that owning the tool isn’t enough when AI makes tools a commodity. You must own the signal. Semrush provides the signal.

This isn’t just a software acquisition. It’s Adobe admitting that in 2025, Data > Design.