How Nvidia became the First $5Tn Company

Nvidia just crossed the $5 trillion valuation mark.

That number isn’t a meme; it’s the final scene of a 20-year movie. It’s the receipt for a bet so bold and so long-term that for most of two decades, Wall Street completely missed it.

They thought Nvidia was a chip company. A cyclical, high-end “graphics card” maker for gamers.

They were wrong.

This was never a chip play. It was an ecosystem conquest. Nvidia wasn’t building “picks and shovels” for a gold rush. It was patiently, methodically building the entire, integrated mining operation, from the language developers think in to the high-speed plumbing that connects the factory floor to the pre-built, turnkey factory-in-a-box.

Highlights: The $5Tn Story

- The 20-Year Bet: How a 2006 software “distraction” (CUDA) became the proprietary language for the entire AI revolution, forming an unassailable software moat.

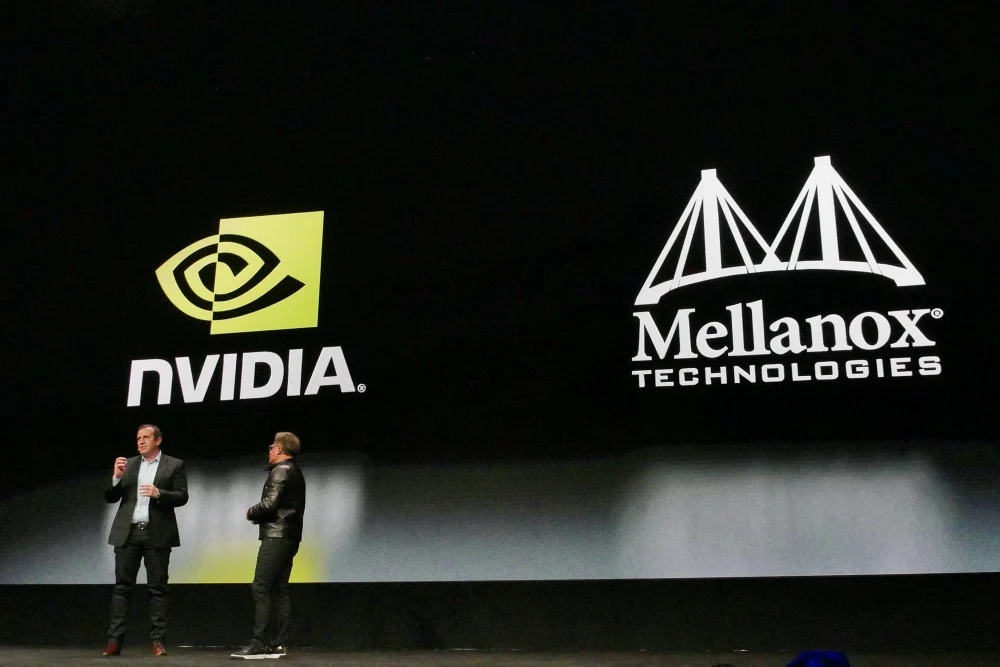

- Systems, Not Silicon: The $7B Mellanox acquisition in 2020 was the pivot point, proving the product wasn’t the chip; it was the entire, high-speed factory.

- The “Factory-in-a-Box”: Nvidia stopped selling $40k parts and started selling $2M DGX racks—complete, integrated “answers” that locked in cloud giants and enterprises.

- The “Re-Rating”: The $5T valuation ignited when the market finally stopped seeing a cyclical hardware maker and started seeing the prime contractor for the new AI industrial revolution.

- The 5-Move Playbook: The story reveals a clear, five-step strategy for owning a market: Own the developer, package the system, monetize the stack, orchestrate supply, and signal dominance.

Here is the story of how they did it.

Chapter 1: The “Distraction” (2006-2011)

The story begins in 2006 with the launch of CUDA.

At the time, no one in finance cared. It was a niche software tool for physicists and academics. It was a “distraction” that allowed researchers to use Nvidia’s gaming GPUs for parallel compute in physics simulations. Wall Street was focused on quarterly PC sales and the next Halo release.

But Jensen Huang and his team had planted a seed. They had created a proprietary language. They had, in effect, built a special kind of railroad track, and then gave it away for free to the smartest people in the world.

They were betting that someone would eventually build a revolutionary new train.

Chapter 2: The Spark (2012-2016)

In 2012, the spark ignited. A new AI model called “AlexNet” won a major image recognition competition, and it did so by a massive margin. Its secret weapon? It ran on two Nvidia gaming GPUs, using CUDA.

This was the “I told you so” moment. This was the revolutionary train. The academic and research community, which had spent years learning CUDA, suddenly standardized. Deep learning needed parallel compute, and Nvidia was the only company that spoke the language.

Nvidia pivoted. The messaging shifted from “graphics” to “accelerated computing.” The bet was no longer a distraction; it was the entire mission.

Chapter 3: Building the Factory (2017-2020)

The bet was paying off, but a new problem emerged. Researchers were now trying to connect thousands of GPUs, and the system was hitting a bottleneck. The “railroad tracks” were fast, but the railyard was too slow.

So, in 2020, Nvidia made its most important move: it bought Mellanox for $7 billion.

The market was confused. Why would a chip company buy a “plumbing” company that made high-speed networking gear?

Because Nvidia realized the product wasn’t the chip anymore. The product was the entire system. To own the AI factory, you had to own the engine (the GPU) and the high-speed conveyor belts (the networking). They didn’t just want to sell parts; they wanted to sell the whole, pre-built, fully optimized factory.

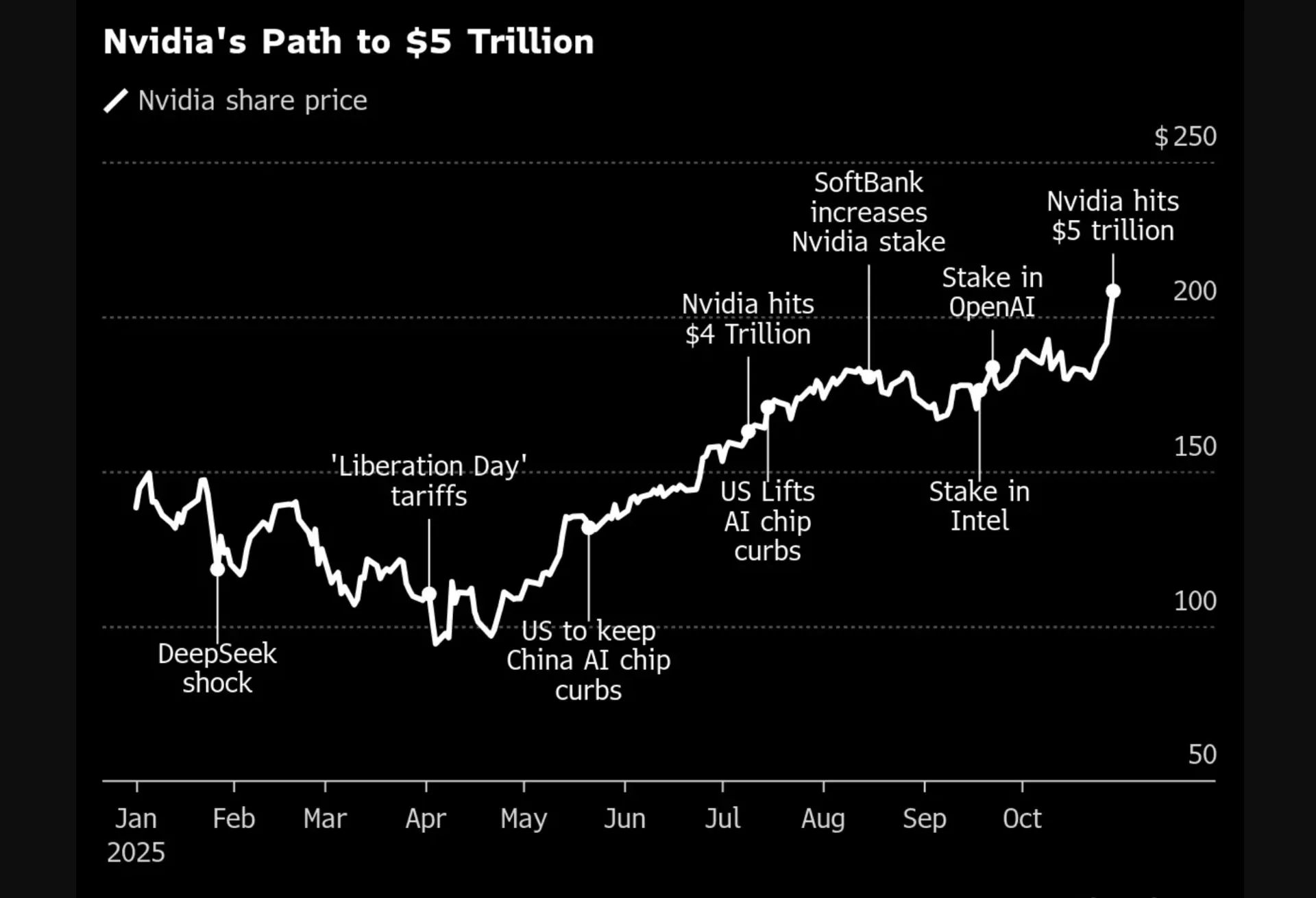

The $5 Trillion Scoreboard

This graph isn’t just a stock chart. It’s a visualization of the moment the rest of the world finally understood the story.

Alt text: A line chart showing Nvidia’s share price from Jan 2025 to Oct 2025, with milestones like “$4 Trillion” and “$5 Trillion” showing a dramatic acceleration in valuation.

Chapter 4: The Rocket (2021-2023)

Then, the rocket fuel arrived. OpenAI, Anthropic, xAI, and the frontier labs.

When ChatGPT was unleashed, it was built, trained, and run on Nvidia hardware. Why? Because of the 2006 bet. CUDA was the only mature, high-performance language available.

The entire world wanted to build their own AI, and there was only one place to turn. The A100 and H100 GPUs became the most sought-after resource on Earth: more valuable than gold, oil, or lithium.

Nvidia wasn’t just selling to gamers or academics anymore. It was selling $2 million “DGX” racks (the factory-in-a-box) to Microsoft, Google, AWS, Meta, and Oracle.

Chapter 5: The “Re-Rating” (2024-2025)

This is the final scene. This is the moment the market finally stopped calling Nvidia a cyclical chip company and re-rated it as the prime contractor for the entire AI industrial revolution.

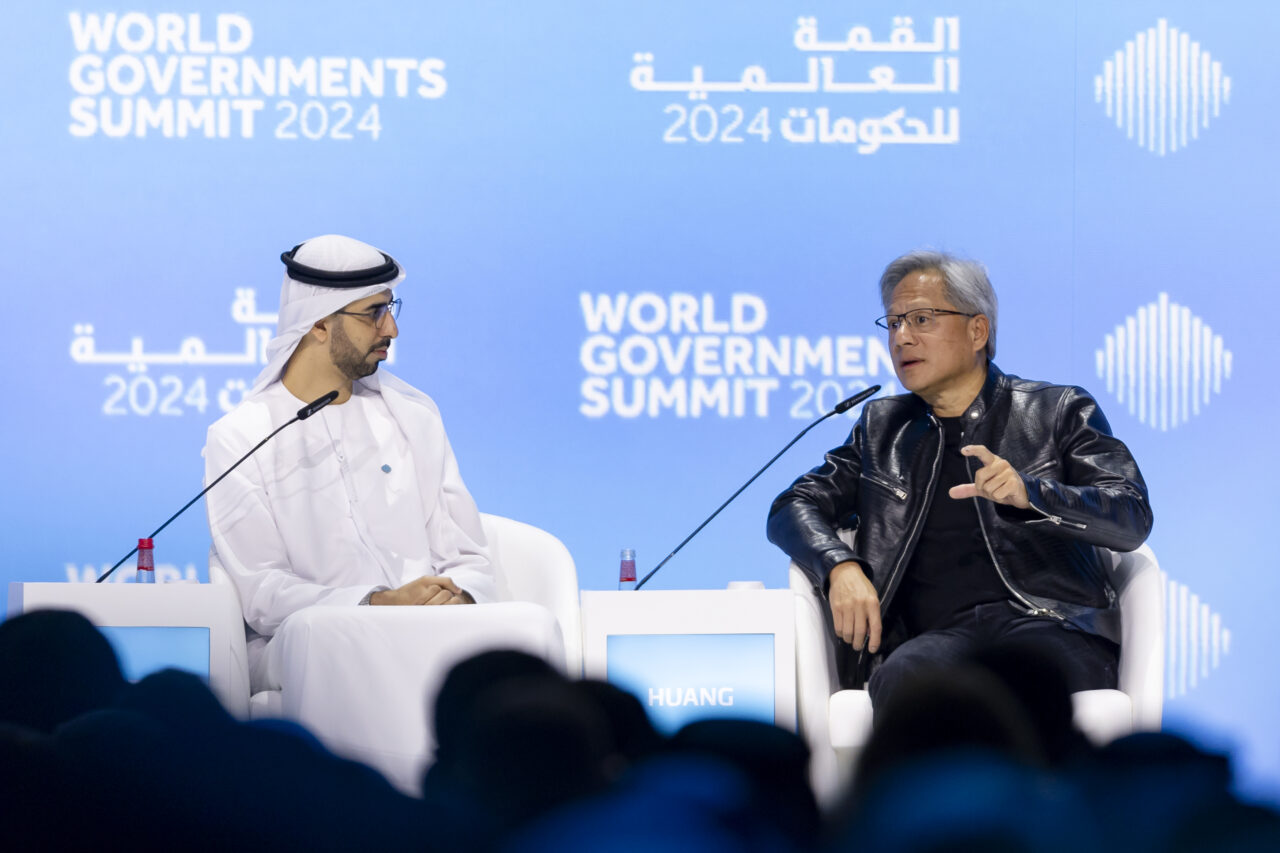

The $5 trillion valuation ignited when AI moved from R&D (demos) to industrial-scale manufacturing (real P&L impact). The myth that inference would be commoditized collapsed. And every government, from the US to the UAE, announced “Sovereign AI” programs, needing to build their own “AI plants”,factories that only Nvidia could equip.

The Moral of the Story: The 5-Move Playbook

Nvidia’s journey wasn’t luck; it was a 20-year playbook.

- Own the Developer: The CUDA bet proved that if you own the language, you own the market.

- Package the System: The Mellanox and DGX moves proved you sell answers, not parts.

- Monetize the Stack: New software (AI Enterprise, NIMs) proves the moat is now generating its own, recurring revenue.

- Orchestrate Supply: Locking in TSMC (CoWoS) and HBM partners starved rivals of oxygen.

- Signal Dominance: When Microsoft and OpenAI became your biggest fans, every other CIO followed.

The BWR Take

Nvidia didn’t just build a better chip. It built the operating system for the 21st century’s most valuable factory.

If you’re a founder or investor, the lesson is clear: own the critical path, not just the part number. Nvidia owns the entire path from a developer’s first line of code to the final, revenue-generating answer. That is the story of $5 trillion.