Netflix Buys Warner Bros: The $83Bn Check That Ended the Streaming War

The Streaming Wars are officially over. Netflix won.

In a move that redefines the entire media landscape, Netflix has announced a definitive agreement to acquire Warner Bros. Discovery (WBD) for $82.7 billion ($27.75 per share).

This isn’t just a merger. It is a capitulation of the old guard.

For a decade, legacy studios tried to build their own “Netflix Killers.” Today, the most prestigious of them all (the house of Harry Potter, Batman, and Game of Thrones) has agreed to become a tile inside the Netflix interface.

But the real story isn’t the price tag. It’s the structure. Netflix isn’t buying everything. They executed a ruthless “Good Bank / Bad Bank” split to secure the assets without the liabilities.

Highlights: The “Crown Jewels” Heist

- The Price: $82.7 Billion (Cash & Stock) at $27.75/share. A premium that finally unlocks value for WBD shareholders after years of stagnation.

- The Strategic Spin-Off: This is the key. Netflix is NOT buying CNN, TNT, or the linear cable networks. Those are being spun off into a separate public company, “Discovery Global.” Netflix bought the IP engine; they left the dying cable ecosystem behind.

- The Content Monopoly: Netflix absorbs HBO, HBO Max, Warner Bros. Pictures, and the DC Universe. This creates a content library so deep it creates an effectively insurmountable churn moat.

- The Regulatory Wall: This deal faces the most hostile antitrust environment in history. Senior White House officials have already flagged “market dominance” concerns.

The Deal Structure: How Netflix Avoided the “Cable Trap”

Why did Netflix win the bidding war against Paramount/Skydance? Because they refused to buy the melting ice cube.

Paramount’s offer included the cable channels. Netflix structured a deal that surgically extracted the Growth Assets (Studios, Streaming, IP) while forcing WBD to spin off the Cash-Cow-but-Declining Assets (Linear TV) into a separate entity.

The “New Netflix” Gets:

- Warner Bros. Pictures: Theatrical distribution engine (Barbie, Dune).

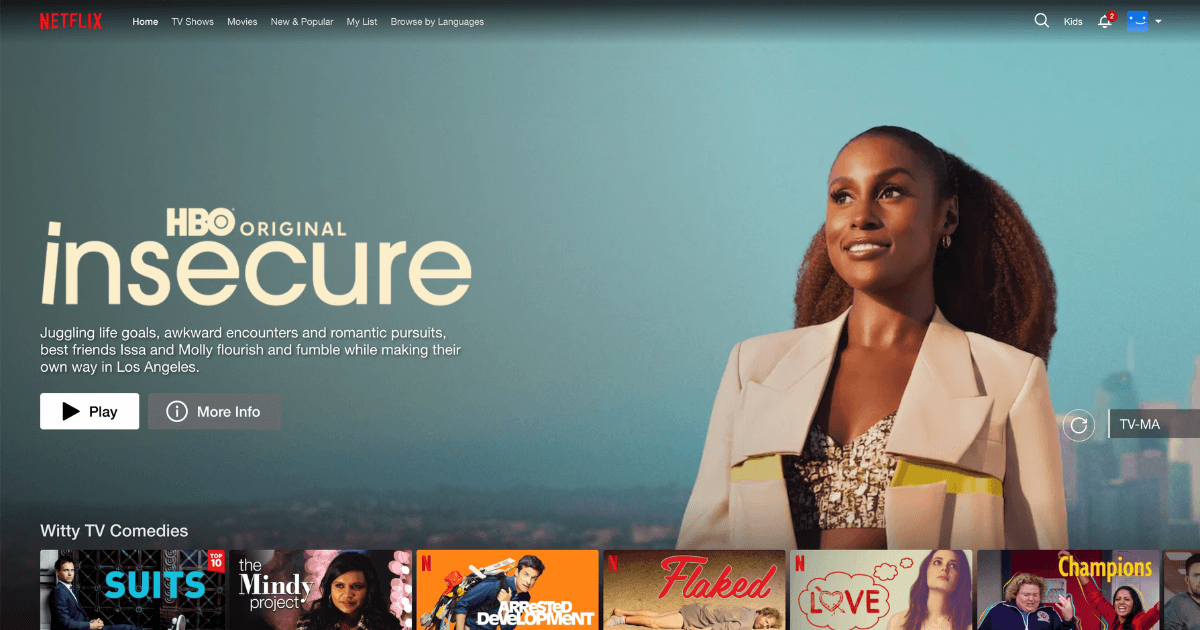

- HBO / Max: The world’s prestige TV brand (Succession, Last of Us).

- DC Studios: Superman, Batman, Wonder Woman.

- The Library: Friends, Harry Potter, Lord of the Rings.

“Discovery Global” (The Spin-Off) Gets:

- CNN, TNT, TBS, Discovery Channel, HGTV.

- The massive, but declining, carriage fee revenue.

- The debt load associated with the linear infrastructure.

Strategic Takeaway: Netflix effectively bought the future of Warner Bros. and left the past to the public markets.

The New Economics: The “Zero-Churn” Bundle

The Streaming Wars were fought on Churn. Users would sign up for House of the Dragon on Max, cancel, and move to Netflix for Stranger Things.

By combining these libraries, Netflix destroys the incentive to switch.

- Pricing Power: Netflix can now legitimately charge $30/month for a “Netflix + HBO” tier. It becomes the new cable bundle, but with zero marginal distribution cost.

- Theatrical Leverage: Netflix confirmed it will maintain theatrical releases. This gives them the “cultural event” engine they lacked. They can launch a Batman movie in theaters (box-office revenue) and secure exclusive global streaming rights on Day 45 (retention value).

The Antitrust War: The Deal Might Not Close

This is the bear case.

- The Complaint: A combined Netflix + HBO controls too much of the “premium attention” market. It gives them monopsony power over labor (writers/actors) and monopoly power over pricing.

- The Defense: Netflix will argue that their competition isn’t just Disney+ or Amazon; it’s YouTube, TikTok, and Fortnite. They will argue the market is “Screen Time,” not just “Long-Form Video.”

- The Political Headwind: With Paramount/Skydance lobbying hard against it, expect a brutal FTC review extending into late 2026.

The BWR Take

This deal proves that Scale is the only strategy left in media.

Warner Bros. Discovery tried to go it alone. They cut costs, they rebranded, they bundled. It wasn’t enough. In the algorithm era, you either own the platform (Netflix, YouTube, Amazon) or you are just a content supplier.

Warner Bros. just accepted its fate as the world’s most expensive content supplier to the world’s biggest platform.